Newable Ventures – The Month That Was

A look back at last month’s key developments in the technology sector and early stage investment market with Newable Ventures

Portfolio News

Sphere Fluidics raised a £30m Series A round

Congratulations to Newable Ventures investee company Sphere Fluidics on their £30m fundraise. The round was led by Sofinnova Partners (Paris, France) and Redmile Group (San Francisco, USA) and will enable Sphere Fluidics to expand the Company’s international sales activities in key markets and improve its support for customers.

Blu Wireless raises £3.55m

Newable Ventures are also pleased to announce that Blu Wireless has closed £3.55m in funding (made up of £1.2m equity at a share price of £0.55, with the rest made up from Convertible Loan Notes). The company is still developing a Network Management System (NMS) that will assist customers to remotely manage their networks. This platform will enable the company to offer a turn-key solution into markets such as high-speed transportation and defence.

Technology News

UK government invests in technology for cyber security

A taskforce of former bankers and financiers is helping the UK military sharpen its skills in economic warfare as a bulwark against growing threats including terrorism, cyber attatcks, and disinformation campaigns. Such skills are in increasing demand as adverseries such as Russia or China have exploited the “grey zone” between war and peace, using cyber weapons to target national infrastructure. The move by the Ministry of Defence also reflects the increased emphasis by the UK government to invest in cyber security technology, such as Cyber Threat Intelligence, and the success of cyber security companies such as Darktrace, which listed on the LSE in the summer.

Prologis Life Science Investment

The world’s biggest warehouse landlord is set to build £450m of new laboratory space in Cambridge as it seeks to cash in on Britain’s booming life sciences sector.

Prologis, which is based in San Francisco, has bought out Countryside Properties, its London-listed joint venture partner, to take full control of the second phase of expansion at Cambridge Biomedical Campus. The life sciences hub on the southern outskirts of the city is Europe’s largest centre of medical research and is home to AstraZeneca and GlaxoSmithKline, as well as Addenbrooke’s Hospital. The facility will be designed so that small businesses, which are a growing part of the life sciences sector, have ready-made labs to work from. Britain’s life sciences industry employs more than 250,000 people and turns over about £81 billion a year. It has emerged as one of the hottest property sectors, with the pandemic having burnished its credentials further in the eyes of investors.

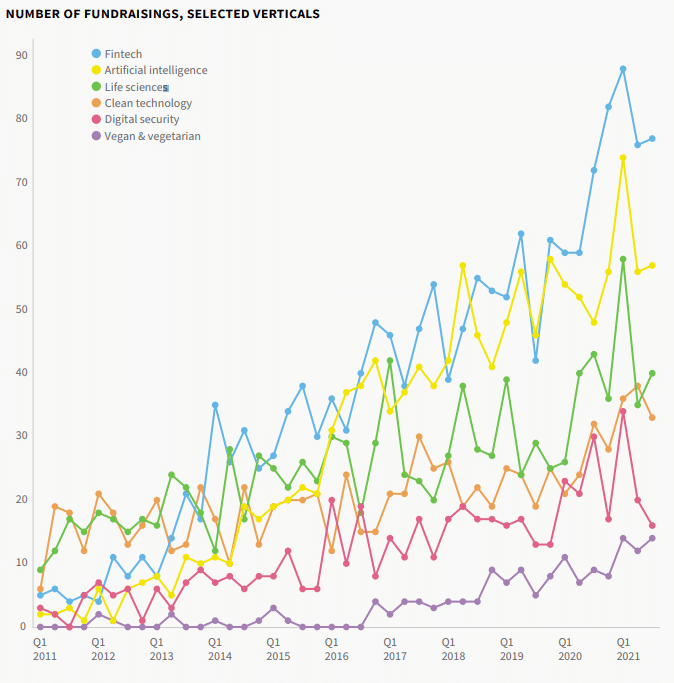

UK Funding Bonanza Continues

UK Venture Capital investment continued to reach new highs, with $9.1bn being raised by UK companies in Q3 2021 alone, analysis by KPMG showed. The latest figures mean that year to date nearly $27bn of investment has been raised in the UK, with sectors such as Fintech, Life Sciences, and Artificial Intelligence being the sectors favoured by investors.

Newable is the leading provider of Money, Advice and Workspace to SMEs. Newable has consistently generated inclusive social and economic impact since its foundation in 1982. Now employing over 550 professional staff, it has grown to become a national business with a presence from Aberdeen to Brighton, serving over 43,000 client companies each year. Newable Ventures is an EIS evergreen Fund that invests in 7-10 portfolio companies in the SpaceTech, MedTech and Automations sectors.

Newable Ventures Limited (FRN 843924) is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales | Registered number 10303336 | VAT number 237 9198 23 | Registered office 140 Aldersgate Street, London, EC1A 4HY. Newable Ventures Limited is registered with the Information Commissioner’s Office (ICO) with the registered Data Protection Number ZA789052. Copyright © 2021. All rights reserved.